Have you ever eagerly planned a dream vacation, meticulously plotting out every detail, only to skimp on one of the most crucial aspects—travel insurance? It may seem like an unnecessary expense, especially when you’re fixated on all the fun and relaxation awaiting you. However, skipping travel insurance can turn a memorable trip into a financial and emotional nightmare.

This image is property of askaconcierge.tv.

The Basics of Travel Insurance

Travel insurance, in a nutshell, is a safety net that protects you from a myriad of travel-related mishaps. Picture this: you’ve booked non-refundable tickets, scheduled numerous tours, and all of a sudden, an unforeseen event turns your plans upside down. Without travel insurance, you could lose thousands of dollars and experience skyrocketing stress levels.

Types of Coverage

Travel insurance isn’t a one-size-fits-all package. It comes in various types, each designed to mitigate specific risks:

| Type of Coverage | What It Covers |

|---|---|

| Trip Cancellation | Reimburses prepaid, non-refundable expenses if the trip is canceled for covered reasons. |

| Trip Interruption | Covers costs if the trip is cut short due to unforeseen events. |

| Medical Emergencies | Covers medical emergencies, including hospital visits and treatments. |

| Evacuation | Covers emergency transportation to the nearest suitable medical facility. |

| Lost or Delayed Baggage | Reimburses you for lost, stolen, or delayed baggage. |

| Travel Delay | Pays for additional expenses incurred due to a travel delay. |

Why It’s Crucial

Imagine arriving at your destination only to realize that your luggage, containing all your clothes and essentials, didn’t make the trip with you. Or worse, you get injured while hiking in a remote location and need urgent medical attention. These scenarios can wreak havoc on your plans and finances, which is why travel insurance is indispensable.

Common Misconceptions About Travel Insurance

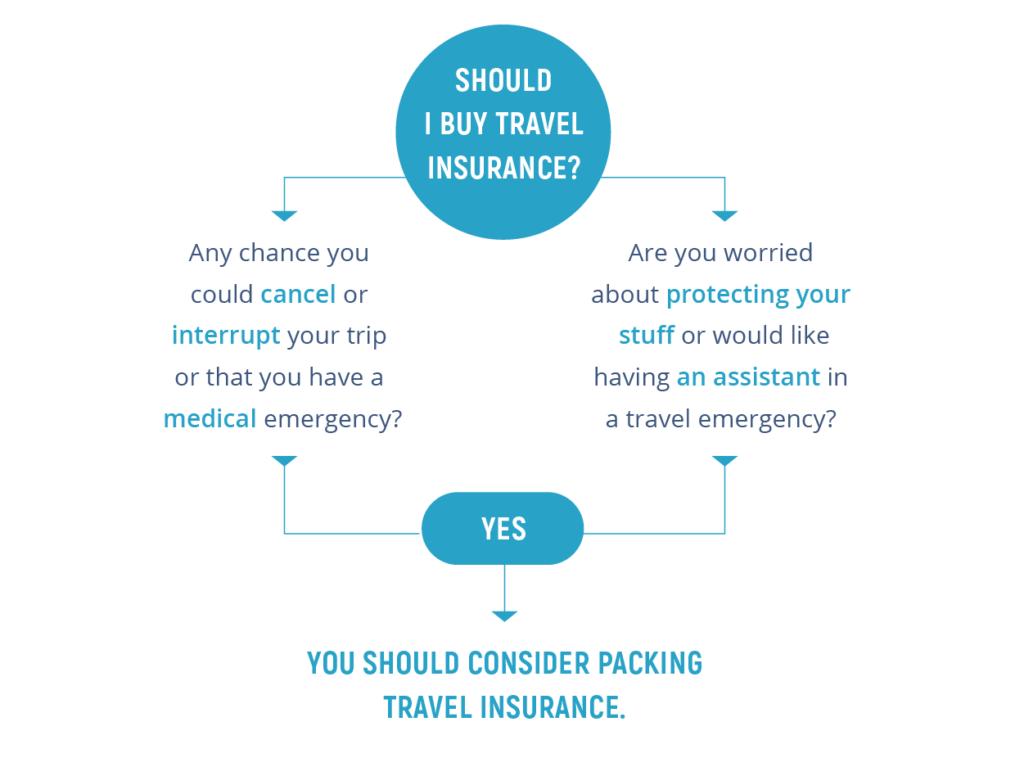

You might be thinking, “I’m healthy, and bad things don’t happen to me.” But here’s the thing: travel insurance isn’t just for worst-case scenarios; it’s for peace of mind. Let’s break down some common misconceptions:

“My Credit Card Has Me Covered”

Some credit cards offer travel insurance as a perk, but the coverage is often limited. For instance, it may cover lost baggage but not medical emergencies. Always read the fine print and consider a standalone policy for comprehensive coverage.

“I Don’t Need It for Domestic Trips”

Believe it or not, travel insurance is just as important for domestic trips. Unexpected events like bad weather, illness, or even job loss can still disrupt your plans. Plus, medical emergencies can be costly even within your own country.

“It’s Too Expensive”

Think of it this way: the average cost of travel insurance is typically 5-10% of your total trip cost. In the grand scheme of things, that’s a small price to pay for peace of mind and financial protection.

“I’m Young and Healthy”

Age and good health don’t immunize you from accidents or unexpected events. From food poisoning to natural disasters, anything can happen, regardless of age or health status.

The Financial Implications

Traveling without insurance can have severe financial consequences. Here’s a deeper look into potential costs you might face without insurance:

Medical Emergencies

Medical emergencies can be exorbitantly expensive, especially if you’re abroad. According to the U.S. State Department, medical evacuation can cost upwards of $100,000! Even a simple visit to a foreign hospital can drain your savings.

Trip Cancellations and Interruptions

Imagine losing all the money you invested in non-refundable tickets, hotels, and tours because of a sudden illness, family emergency, or unexpected event. Travel insurance can reimburse these costs, ensuring you’re not out of pocket.

Lost or Stolen Items

Losing your luggage or having your possessions stolen can be more than just a nuisance. Replacing essential items can add up quickly. Travel insurance can help cover these unexpected costs, so you’re not left scrambling.

Real-life Anecdotes and Scenarios

Believe me, I’ve heard countless horror stories from friends and family who thought they could sidestep travel insurance. There’s the tale of my adventurous cousin who broke his ankle while hiking in the Swiss Alps. He had to be airlifted to the nearest hospital—and without insurance, the cost was astronomical.

Then, there’s the story of my college roommate who was all set to attend a destination wedding in the Caribbean, only to be sidelined by a medical emergency. She hadn’t bought travel insurance and ended up losing thousands in non-refundable expenses.

Real Story: The Honeymoon Disaster

A newlywed couple I know had their luggage lost en route to their honeymoon destination. They had no travel insurance and ended up spending a significant portion of their travel budget replacing lost items and buying essential clothing. What started as a dream trip quickly turned stressful and financially draining.

This image is property of i0.wp.com.

Peace of Mind

One of the most underrated benefits of travel insurance is the peace of mind it offers. Knowing you’re protected against unforeseen mishaps allows you to enjoy your trip without the constant worry of what could go wrong.

Comprehensive Assistance

Good travel insurance policies also offer 24/7 assistance services. These services can help you find medical facilities, arrange evacuations, and offer other essential support regardless of where you are in the world.

Emotional Safety Net

It’s not just financial peace of mind. Knowing you have a plan in place for emergencies helps reduce stress and anxiety, allowing you to savor every moment of your trip.

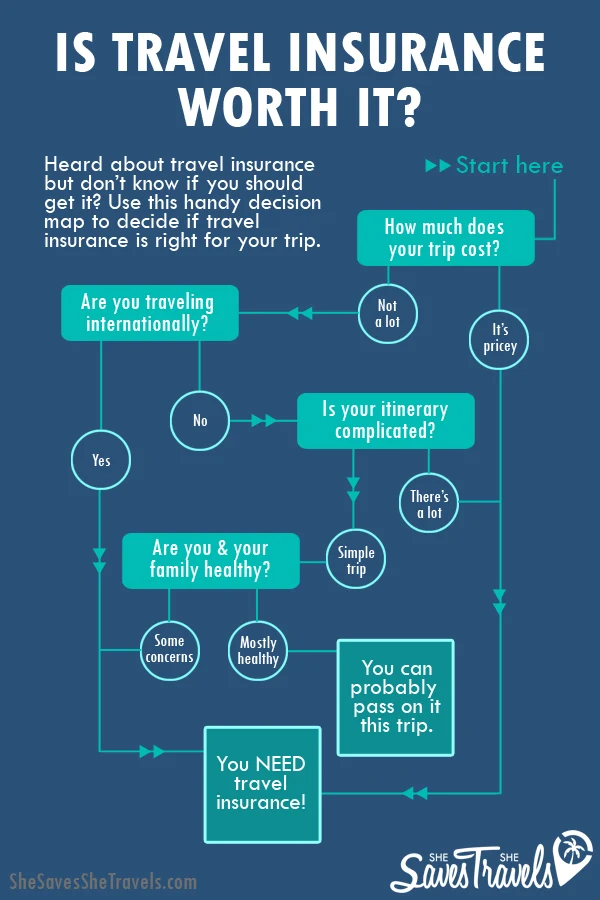

How to Choose the Right Travel Insurance

Selecting the right policy can be overwhelming, but it doesn’t have to be. Here are some key factors to consider:

Coverage Needs

Determine what you need coverage for—is it medical emergencies, trip cancellations, or lost baggage? Make sure the policy you select covers all your specific needs.

Read Reviews

Customer reviews and ratings can provide insights into the reliability and efficiency of the insurance provider. Look for reviews that focus on claims processing and customer service.

Compare Policies

Use comparison websites to check prices and coverage options side-by-side. This helps ensure you’re getting the best deal without sacrificing essential coverage.

| Factor | Questions to Ask |

|---|---|

| Destinations | Does the policy cover all the countries you’ll visit? |

| Activities | Are all your planned activities, such as skiing or diving, covered? |

| Pre-existing Conditions | Does it cover pre-existing medical conditions? |

| Budget | Does it fit within your travel budget while providing necessary coverage? |

Fine Print

Always read the policy documents to understand the terms and conditions. Pay attention to exclusions and limitations to avoid unpleasant surprises.

This image is property of www.datocms-assets.com.

Timing is Everything

When should you buy travel insurance? Ideally, you should purchase it as soon as you’ve booked your trip. Some policies offer better benefits if bought within a certain time frame after making your initial deposits.

Early Purchase Benefits

Buying travel insurance early can provide additional benefits like “Cancel for Any Reason” coverage, which offers more flexibility if your plans change unexpectedly.

Waiting Periods

Keep in mind that some policies have waiting periods before certain coverage becomes effective. Early purchase ensures you’re covered from the get-go.

Last-Minute Purchases

While it’s best to buy early, some policies can be purchased just before your trip. However, understand that last-minute policies may offer limited coverage and higher premiums.

Making a Claim

Filing a claim shouldn’t be a complicated process. Most insurance companies have streamlined procedures to help you submit claims quickly and easily.

Documentation

Keep all necessary documentation like receipts, medical reports, and police reports handy. These will be required to support your claim.

Timelines

Be aware of the time limits for filing claims, as delays can lead to denial. Check your policy for specific timelines.

Follow Instructions

Follow the insurance company’s instructions for filing a claim meticulously. Incomplete or incorrect information can delay the process.

This image is property of shesavesshetravels.com.

Common Pitfalls to Avoid

It’s easy to make mistakes when it comes to travel insurance, but being aware of them can save you from unnecessary hassles.

Ignoring the Exclusions

One of the biggest mistakes is not reading the exclusions. These are conditions or situations not covered by your policy. Understanding these helps manage your expectations.

Underestimating Needs

Don’t underestimate your coverage needs to save money. This can backfire if you face significant medical expenses or trip disruptions.

Not Comparing Policies

Failing to compare policies can result in missing out on better coverage or lower premiums. Always shop around for the best deal.

Missing Deadlines

Whether it’s for purchasing the policy or filing a claim, missing deadlines can void your coverage. Always be aware of crucial timelines.

Final Thoughts

Travel insurance is more than just an added expense; it’s an essential part of your travel planning. It provides a safety net that covers a wide range of potential mishaps, ensuring you can enjoy your trip without constant worry. From covering medical emergencies and trip cancellations to reimbursing lost or delayed baggage, the benefits far outweigh the costs.

Recap of Key Points

- Types of Coverage: Understand the different types of travel insurance to choose the right policy.

- Misconceptions: Don’t fall for common misconceptions; travel insurance is essential for everyone.

- Financial Implications: Avoid potential financial pitfalls by having adequate coverage.

- Peace of Mind: Enjoy the emotional and financial peace of mind that travel insurance offers.

- Choosing the Right Policy: Select a policy that fits your needs and budget.

- Timing: Purchase travel insurance as soon as you book your trip for maximum benefits.

- Claims Process: Be prepared to file claims efficiently by keeping all necessary documentation.

- Avoid Pitfalls: Be aware of common mistakes to avoid any unpleasant surprises.

So, next time you’re planning a trip, whether it’s a weekend getaway or an international adventure, don’t overlook the importance of travel insurance. It’s a small investment that can save you from significant financial and emotional distress. You’ll thank yourself later when you can focus on enjoying your journey instead of worrying about what might go wrong.

Happy travels, and may your adventures be as safe as they are exciting!

This image is property of www.hotbeautyhealth.com.